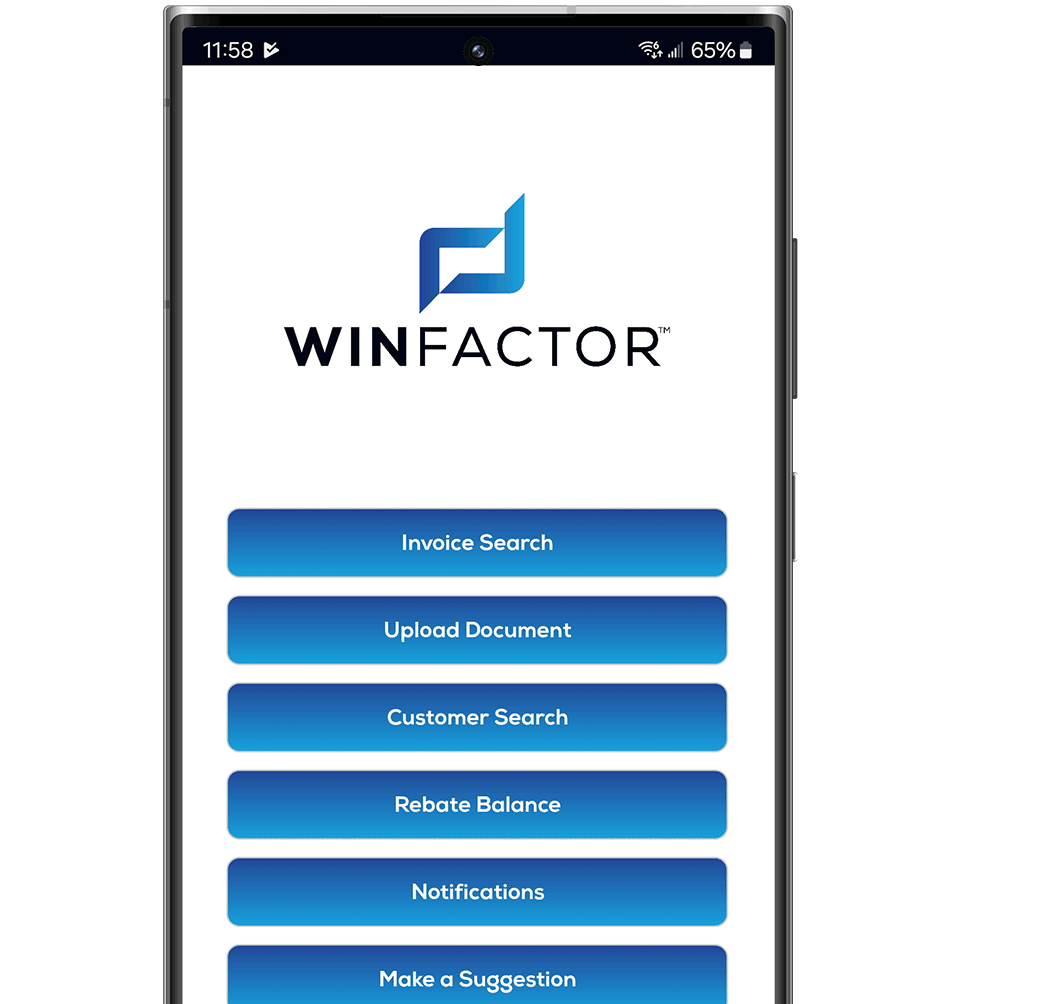

Simply The Best

Factoring Software

Loaded with all the features you would

need in a factoring software.

Operations Team Tools

Manager Workflow

WinFactor’s unique Workflow Screens is part of what makes it the best invoice factoring software. You can populate tasks each day so no responsibility gets overlooked. Workflow screens allow for efficient use of employee groups and assignments. Managers can easily monitor progress of task completion each day.

Reports for all aspects of your business

Part of what makes WinFactor™ the best factoring software is that it has 286 different reports allowing you to slice the data any way you need to. Easily access both internal and client facing reports, to maximize the information you and your customers have to make decisions.

Security is our priority

WinFactor™ is SOC 2 Type 2 Compliant and built on Amazon Web Services’ (AWS) SOC2 Type 2 secure environment. This ensures the highest level of security and compliance. Learn more about our security and technology.

Sales Workflow

Customer Support

Schedule a Demo

WinFactor™ has been the leader in this space for years. We offer the best factoring software and are built specifically for the Transportation Factor. That is why every feature and function is designed to make your workflow easier and faster. Schedule a demo today.