WinFactor™

Vs

Jack Henry™ FactorSoft®

You’re always our top priority. We deliver new features every month and are committed to providing an exceptional customer experience at every step.

Jack Henry™ FactorSoft® and WinFactor™ Comparison

Platform

Platform |

WINFACTOR |

FACTORSOFT® |

COMMENTS |

|---|---|---|---|

| User interface has been redesigned within the last 3 years | WinFactor’s user interface has been recently updated. | ||

| Entire Platform is optimized for mobile device viewing | FactorSoft’s factor portal was designed for desktop usage | ||

| TMS Integrations | WinFactor has active TMS integrations. FactorSoft has only fixed import functionality |

Client Portal

Client Portal |

WINFACTOR |

FACTORSOFT® |

COMMENTS |

|---|---|---|---|

| Client portal allows invoice submission | |||

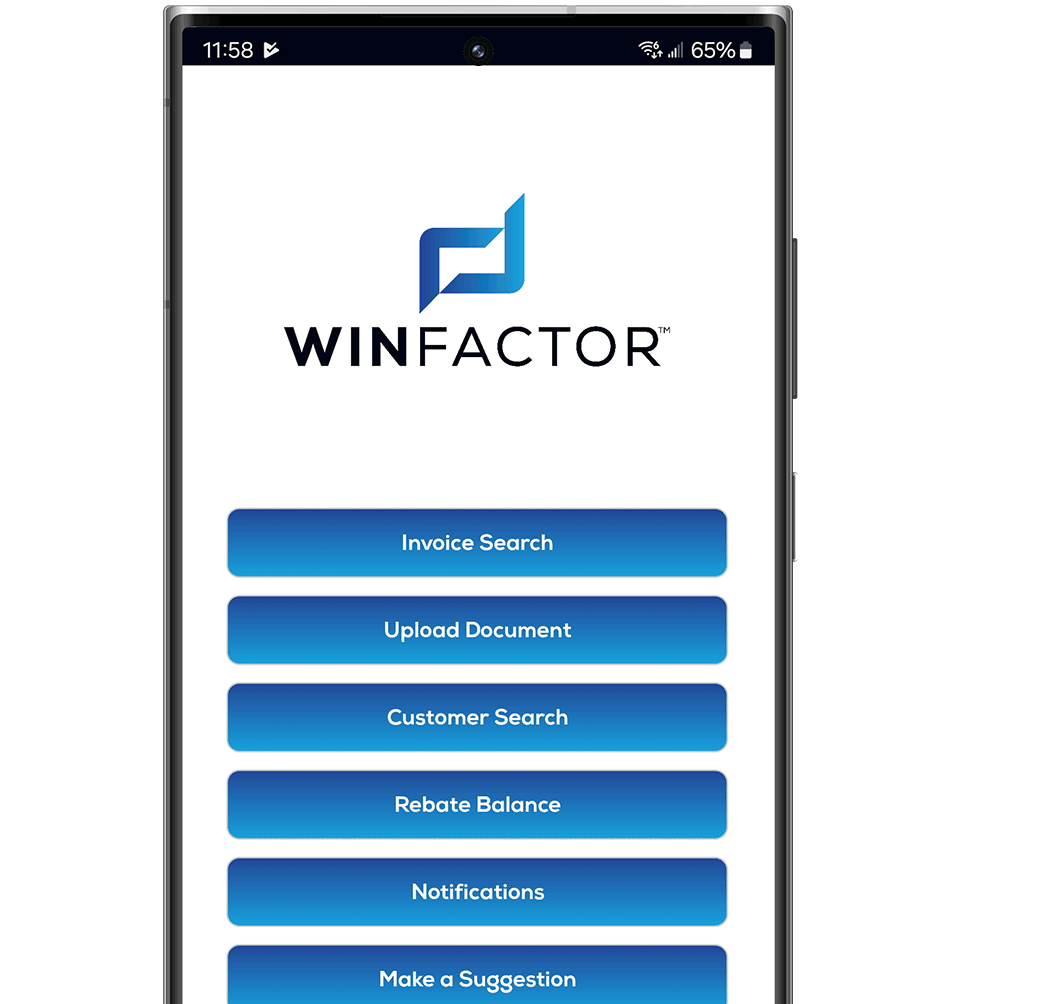

| Mobile App | WinFactor has a Android and iOS mobile App. FactorSoft does not. | ||

| Check payment status for submitted invoices | |||

| Ability for Carrier to check debtor credit worthiness for new debtors. | FactorSoft does not have debtor information if they have not been previously setup. WinFactor’s credit alliance is available in the Client Portal for Carriers to check credit worthiness of debtors using FMCSA data and data from other WinFactor users. | ||

| Carrier can compare and verify rate sheets, call status and load numbers using crowdsourced data | WinFactor’s credit alliance is available in the Client Portal for Carriers to check credit worthiness of debtors prior to making a haul. | ||

| White Labeling |

Credit Management Tools

Credit Management Tools |

WINFACTOR |

FACTORSOFT® |

COMMENTS |

|---|---|---|---|

| Assign Client Credit Limits | |||

| Audit client Credit request History | |||

| Integration with 3rd party credit agencies | |||

| View detailed credit information on Debtors using crowdsourced data | WinFactor’s credit alliance is integrated with the Federal Motor Carrier Safety Administration (FMCSA), delivering a nightly feed that updates broker authority status and registration information within our credit system. WinFactor customers also share data on credit status, average days to pay, recent load numbers and comments. | ||

| New Debtor Early Alert System | Factor creates a Credit Risk Profile during WinFactor setup. When adding a new Debtor, WinFactor cross references credit alliance data from other factors to display instant Buy, Call First and No Buy status based off of Credit Risk Profile. | ||

| Live Federal Motor Carrier Broker Authority Feed | WinFactor has a nightly feed integrated into the platform from the FMCSA on broker status. You will know as soon as broker status changes. FactorSoft does not have this integration. | ||

| Rate Sheet Verification | When reviewing your clients’ paperwork, you can easily compare any rate sheet you’ve received with other bona fide rate sheets shared by a fellow Factors. Unique to WinFactor™, this feature enables you to identify fraudulent rate sheets before making a purchase, safeguarding you from potential costly errors. | ||

| Recent Load Number Comparison | WinFactor allows you to compare your new rate sheet load numbers with current verified load numbers from other factors. | ||

| View Average Days to Pay by Debtor based on other Factor’s receivables | WinFactor allows you to view average Days to Pay by Debtor from other factors data without the use of a third party. | ||

| Automatic Buy, No Buy, Call First Flagging from crowdsourced data | WinFactor allows you to view average buy, no buy, call first status from other factors |

Client Terms

Client Terms |

WINFACTOR |

FACTORSOFT® |

|---|---|---|

| Customizable templates by client | ||

| Infinite Fee structure Capability | ||

| Advance and Discount Rates | ||

| Fee Rules |

Relationship Configuration

Relationship Configuration |

WINFACTOR |

FACTORSOFT® |

|---|---|---|

| User-Defined Roles | ||

| Configure unique banking and billing information | ||

| Configure unique NOA templates | ||

| Assign credit buy/no-buys/call first | ||

| Configure funding instructions | ||

| Store pertinent client documents |

Document Management

Document Management |

WINFACTOR |

FACTORSOFT® |

COMMENTS |

|---|---|---|---|

| Automated built-in document submission technology and TMS integrations | WinFactor offers 7 different ways to submit documents and PDFs to the platform. WinFactor also has multiple integrations with TMS softwares to automate submissions. | ||

| Platform uses optical character recognition (OCR) technology to scan invoices quickly and accurately. | |||

| Automated invoice creation from emailed attachments | |||

| Track invoice payments, schedules and due dates | |||

| Easily manipulate invoice PDFs within the software for organization and payment | Easily manipulate PDF documents within WinFactor. No need for a separate editor. Crop, annotate, combine and burst documents easily. |

Reports and Auditing

Reports and Auditing |

WINFACTOR |

FACTORSOFT® |

|---|---|---|

| Create or pull hundreds of custom reports for all aspects of your business | ||

| Client Overview | ||

| Aging reports | ||

| Chargeback Report | ||

| Audit trails |

Debtors

Debtors |

WINFACTOR |

FACTORSOFT® |

|---|---|---|

| Manage account debtors, their relationships, and credit limits | ||

| Assign global debtor credit limits to ensure you are not over exposed across your clients | ||

| Configure global buy/no buy | ||

| Track and assign credit limits through credit alliance or third party integration |

Collections

Collections |

WINFACTOR |

FACTORSOFT® |

|---|---|---|

| Highly configurable collections pipeline for automating work | ||

| Charge back management | ||

| Track clients, debtors, and sub-debtors, number of invoices, accounts receivable and fees | ||

| Maintain visibility into your accounts receivable |

Total Funding Management

Total Funding Management |

WINFACTOR |

FACTORSOFT® |

COMMENTS |

|---|---|---|---|

| Automate payment tracking and import lockbox files | |||

| Import lockbox key file and automatically pair | |||

| Quickly determine outstanding payments by ledger-type | |||

| Authorize and facilitate payments to clients | |||

| NACHA files for batch uploading of all the ACH transactions in a single file per day | |||

| Customize wire files on demand | FactorSoft requires professional services to create new wire files. WinFactor does not. | ||

| Digital Wallet | WinFactor’s digital wallet offers flexibility for customers to choose funding method. Funding methods include ACH, Wire, Fuel cards, Pre-paid cards and more. |

FactorSoft® is a registered trademark of Jack Henry & Associates, Inc.® This comparison is for informational purposes only and is not affiliated with, endorsed, or sponsored by Jack Henry & Associates, Inc. Our use of the FactorSoft® trademark is solely to identify the product for comparison purposes and does not imply any association with or endorsement by Jack Henry & Associates, Inc. All rights in the FactorSoft® trademark remain the property of Jack Henry & Associates, Inc.

Schedule a Demo

WinFactor™ has been the leader in the factoring software space for years. Every feature and function of our invoice financing platform is designed to make your workflow easier and faster.