Banking Independence and Client Convenience

The introduction of WinFactorPay™ not only offered immediate financial solutions for the carrier, but it also provided Dorado Finance with a means to bypass traditional banking hours. Trace conveyed the significance,

“Adding the element of the card takes the bank cutoff time and the bank holiday out of the equation. With the click of a button, our clients are instantly funded.”

For clients, this translated into unprecedented convenience and independence. Trace highlighted,

“Clients now have the power to say, “Put the money in my Client Wallet within Winfactor™ and then I will decide if I need an ACH or Wire or if I want to instantly put funds on my card.”

Insights Beyond Traditional Credit Reports

Traditional credit reports are often limited on the data they can provide in the age and summary form of the payment data submitted to the credit reporting company. By comparison, WinFactor’s payment and volume data is refreshed daily and provides the most precise data available in the industry, including a daily update of FMCSA broker authority status. Trace Reddick emphasized, “

“Via WinFactor’s Credit Alliance, we gain significantly better insights into the credit of the debtor than a credit report.”

The Credit Alliance information displayed within WinFactor™ goes beyond conventional methods of evaluating credit worthiness; it also extends to evaluating potentially fraudulent paperwork. Dorado Finance taps into the Credit Alliance to access a broker’s average days to pay and invoice volume, recent load number sequences, examples of true broker rate sheets, brokers’ NOA email contacts and invoice delivery methods. Furthermore, WinFactor™ analytics alert Trace to payment and volume changes over time. The integrated credit feature provides invaluable insights, surpassing the limitations of traditional credit reports.

This functionality within WinFactor™, allows Dorado Finance to make informed decisions by comparing information from various sources. The platform’s tools assist in evaluating debtor credibility more accurately, empowering them to make strategic decisions that minimize risk exposure.

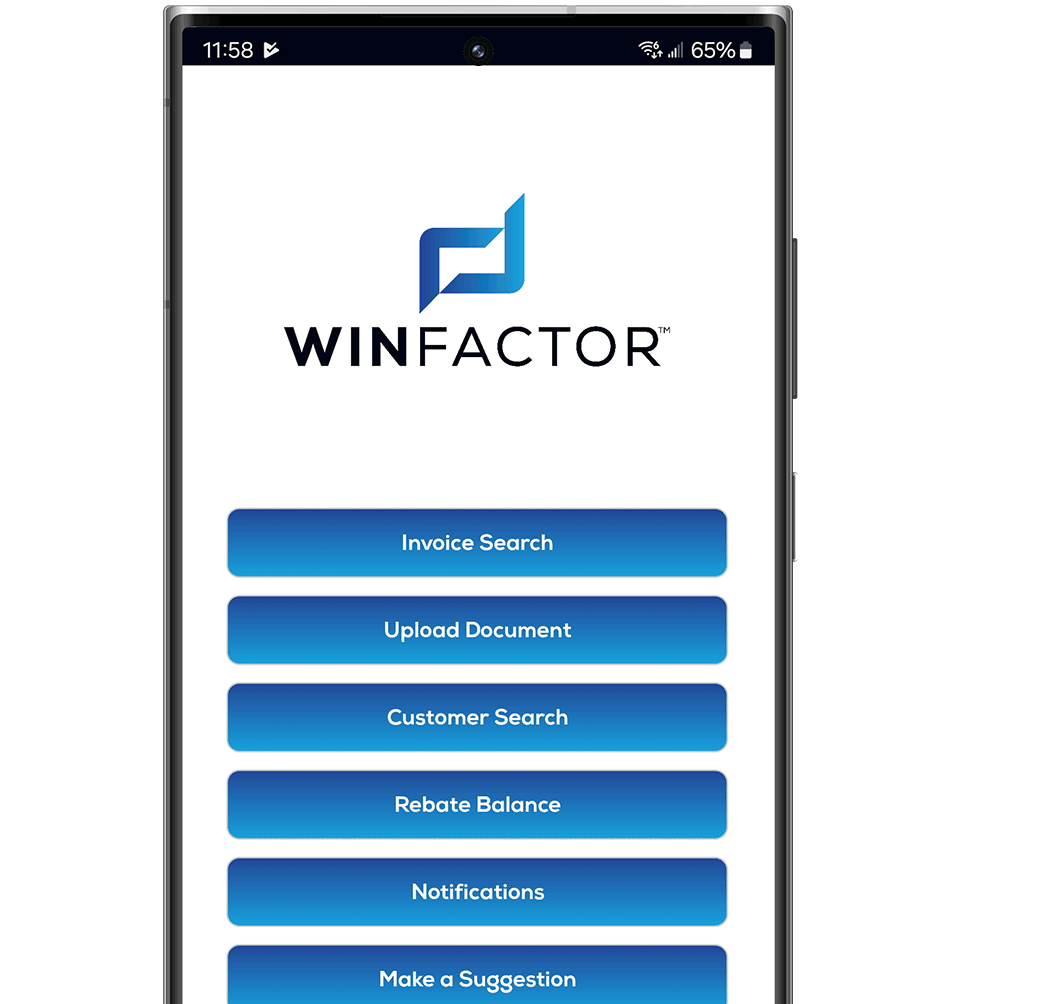

WinFactor™ has been the leader in this space for years. Our software factoring platform is built specifically for the Transportation Factor. That is why every feature and function is designed to make your workflow easier and faster. Schedule a demo today.